Keeping a close eye on the bottom line can help avoid unforeseen financial losses and downsizing. Financial ResponsibilityĪs a business owner or manager, you likely have a team that is basing their livelihood on the success of your decisions. Accurate Future Projectionsįailure to properly track your expenses can cause errors in future budget projections. For internal projects, keeping digital receipts logged can give a better picture of the return on investment.

By accurately tracking expenses you can keep a closer eye on the cost and profitability analysis. Keep your Prices ProfitableĮvery business wants to stay competitive, but slashing prices can also cut into your profit margin. Tracking personal expenses is important for good financial insight and this is even more important in business. Advantages of Tracking Digital Receipts for Business Two great pieces of information to arm yourself with before you make your next purchase. Tracking your receipts can also be a great way to track exactly how long the brand you bought stayed in good running order and how much was spent.

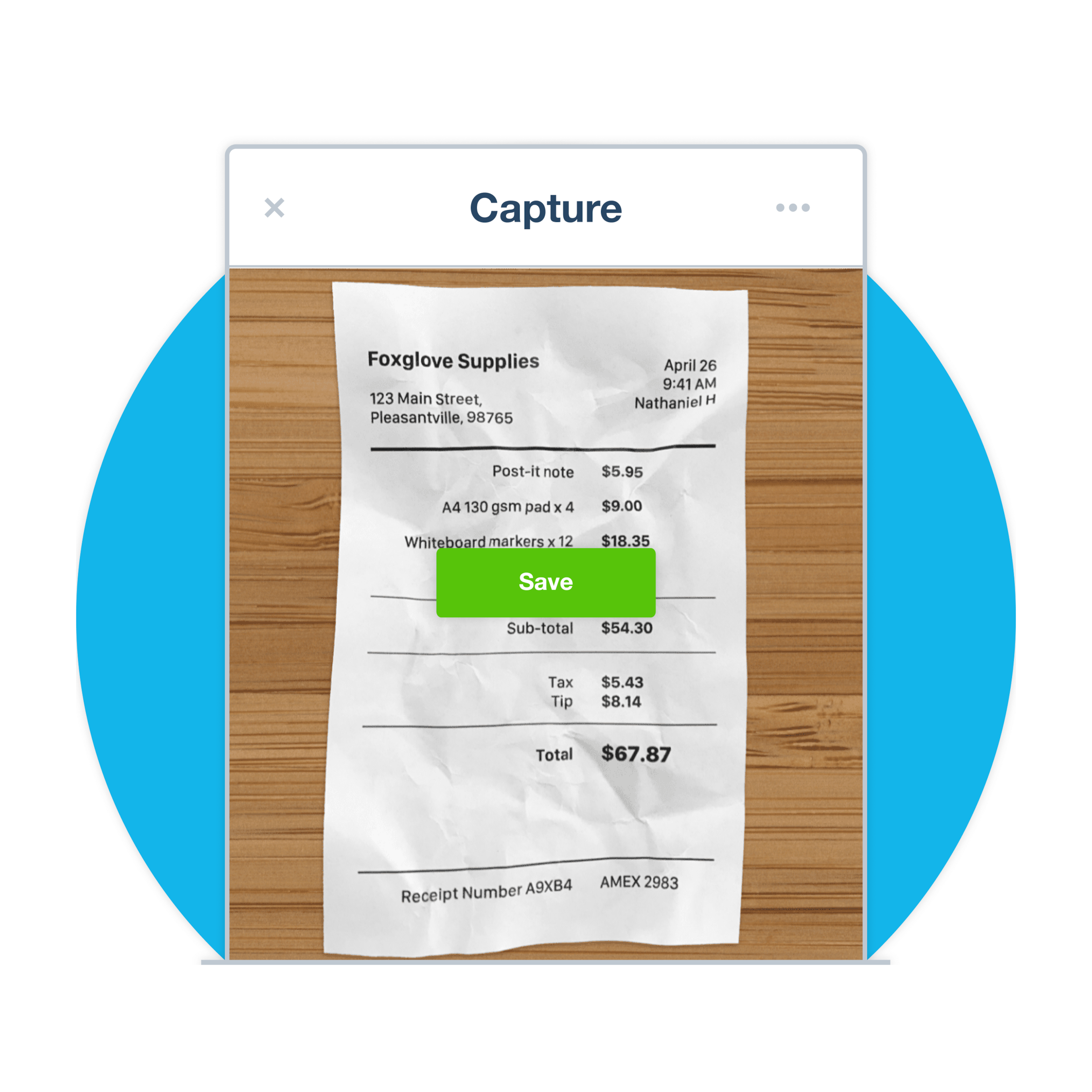

This is not always a great option if you are less than happy with the store products.Ĭheck out the top online stores with the best return policies. Having a digital copy for your major (and minor!) purchases can help protect your investments.ĭefective items that are returned without a receipt often are only good for a return or store credit. After all, most receipts end up in the garbage, getting washed in your pockets or have ink that fades over time. Keeping a paper receipt for major purchases can be a crap shoot at best. It May Alleviate StressĪccording to a survey by the American Psychological Association:ħ2 % of Americans reported feeling stressed about money in the last month.īy tracking expenses, keeping a budget and working towards your financial goals you are taking proactive steps to alleviate that stress.Ĭheck out our best ways to budget. Once you know your monthly expenses, you can evaluate where you may be able to cut back. The first step in taking control of your financial future is often taking an honest look at how much money you are spending. According to a survey by SunTrust, those who responded to say they had relationship stress listed financial issues as the primary cause. Save money on groceries each month! Check out our best grocery rebate apps! It May Help with Personal Relationshipsįinancial woes are a primary cause of friction. By first tracking your expenses you can get a sense of how much you are currently spending and which areas you may be able to cut back in. Many people do not realize the actual amount that they are spending on key items. When you aren’t aware of your spending habits you can budget too much or too little resulting in frustration and an inclination to give up. You can’t create a budget until you know how much your spending. Would you be as tempted to online shop if you had to log each and every receipt? Would you spend as mindlessly or as much? It Can Help you Make a Budget Better Insight into Spending HabitsĪccording to a survey of spreadsheet users by, those who tracked their expenses for three months, 93 % agreed that they had better insight into their spending habits. It’s as simple as tracking your expenses. No matter how dire your financial situation may seem, there is an easy way to work towards improvement. Receipt Tracking Benefits for the Individual: Excluding home loans, the average debt was $12, 875. The majority of Americans are not only currently in debt, but 73 % will pass away with some debt to their name.Īccording to December 2016 data provided to by credit bureau Experian, the average debt including home loans was $61,554. Sadly, debt is a common occurrence in the average American home. Here is a breakdown of the percent of Americans in debt according to their generation gap: With the absence of a budget comes the danger to overspend and find yourself in debt. How well do you really know your spending habits? According to a survey from Gallup, two-thirds of Americans do not track their monthly spending. By keeping a close eye on your expenses, you can get a clearer image of how much you are spending each month. Tracking and logging receipts can help you keep an accurate financial record. Instead of sorting through piles of paper to find specific expenses, you can easily search by keyword. In fact, anyone can benefit from this detailed financial snapshot.

It’s not only business owners who benefit from tracking and storing receipts. Why Should you Store Receipts Electronically? Do you Still Need to Keep Paper Receipts?.Mobile Apps to Organize Receipts and Expense Reports.Which is the Best Way to Organize Receipts Electronically?.Advantages of Tracking Digital Receipts for Business.It May Help with Personal Relationships.

Receipt Tracking Benefits for the Individual:.Why Should you Store Receipts Electronically?.

0 kommentar(er)

0 kommentar(er)